Thank you for visiting

Learn Your Gap.

In ancient Egypt, copper was used to sterilize wounds and drinking water. Ancient Aztecs gargled water mixed with copper to fight sore throats, and Hippocrates reportedly treated leg ulcers with copper. Today, scientific research has proven that copper has an antimicrobial effect, which is why more hospitals around the world are finding ways to use copper equipment to stem hospital infections.

The Food and Nutrition Board at the Institute of Medicine recommends that adults consume about 900 micrograms of copper daily through foods such as dark chocolate, nuts, seafood, legumes, liver and green leafy vegetables. Throughout time, healers have believed that copper is capable of transferring energy to aid the healing process in both the body and mind.

While there’s concern about using up our earth’s supply of resources, we’re in no danger of running out of copper. Scientists estimate that the earth is home to more than 8 trillion pounds of it and that we’ve only mined about 1.1 trillion pounds of it so far. The best part: The metal we’ve already mined can be recycled and reused infinitely without compromising its integrity.

Please enjoy the complimentary

“Learn Your Gap” Yeti mug.

Questions about coverage, an insurance claim, property damage?

Call 772.237.0892 and maybe we can meet for coffee and discuss.

Enjoy your complimentary Yeti while supplies last.

Take a read through the following common events in property insurance claims. Policy language has been around a long time like copper. Policy language can be “soft” to you the property owner.

Like copper the language should be a conduit to protect you and your family during unexpected events. The right amount of insurance coverage is healthy to ensure your largest financial investment is properly protected. If you have the right policy language, the policy language, like copper, should heal the wounds to your home. Providing connectivity for you and your family to pre loss condition at your home.

If you have questions about your coverage, best to call your agent, or we can explain these common claim adjusting issues. Be proactive – vs – reactive. Recovery Insurance Adjusters advocates for property owners only during a claim event. Make sure you have good language which will enable you to be paid the proper claim value. Some policyholders buy insurance coverage on “price point” – vs – the fine details of the policy language.

Here are some common events and associated policy language that you might have in your policy.

You might be surprised to learn these gaps might not allow you to put your property back to pre-loss condition after a sudden event.

Topics Covered:

Emergency Services Dollar Value Limit

You go out for dinner on Friday night. You arrive home after 4 hours and your kitchen sink plumbing supply line failed and water is pouring into your home. Every room is impacted with standing water. You call a company to your home and they arrive at 5:00 am to extract this water. They require you to sign paperwork. You read the paperwork hastily to get the water out of your home!

You go out for dinner on Friday night. You arrive home after 4 hours and your kitchen sink plumbing supply line failed and water is pouring into your home. Every room is impacted with standing water. You call a company to your home and they arrive at 5:00 am to extract this water. They require you to sign paperwork. You read the paperwork hastily to get the water out of your home!

Does your policy language have language to limit emergency services incurred expense?

Some policy language would not pay more than the greater of $3,000 or 1% of the home’s insured value, unless you, the insured submitted a written request to exceed the cap. Once a request is made, the insurance company has 48 hours to approve or reject the request. If the insurance company misses the 48-hour deadline, the claimant may exceed the cap “only up to the cost incurred” for the reasonable emergency measures necessary to protect covered property from further damage.” Is it possible to communicate within 48 hours over a weekend?

What? Yes, you might be responsible to pay a dollar value above $3,000. We have seen policyholders become responsible for dollar values over $20,000 dollars out of their own pocket.

Water Damage Limit $10,000

You take a family weekend away. You arrive home and discover the washing machine hose failed and discharged water throughout your home. You have approximately $100,000 dollars in building damages (wood floor throughout the home, baseboards, drywall, kitchen cabinets, bathroom vanity, etc.)

You take a family weekend away. You arrive home and discover the washing machine hose failed and discharged water throughout your home. You have approximately $100,000 dollars in building damages (wood floor throughout the home, baseboards, drywall, kitchen cabinets, bathroom vanity, etc.)

Does your policy language have language to limit water damage? An example of a Florida policy “This policy provides up to $10,000 of coverage due to Water Damage caused by accidental discharge of water from plumbing or appliance. All other Water Damage is excluded except Water Damage caused by water penetration into the house when the water penetration is a direct result of damage caused by wind or hail.”

Cosmetic Damage Limit

Hail damage to a metal roof or even tile floor system that was damaged by an impact … some polices have implemented a limit of $10,000.00 for cosmetic issues to your home. The insurance carrier has determined these two examples to be cosmetic and limited payments to policyholder at the maximum $10,000. Even thought the value of these items could reach into the $30,000 to $100,000 or higher.

Hail damage to a metal roof or even tile floor system that was damaged by an impact … some polices have implemented a limit of $10,000.00 for cosmetic issues to your home. The insurance carrier has determined these two examples to be cosmetic and limited payments to policyholder at the maximum $10,000. Even thought the value of these items could reach into the $30,000 to $100,000 or higher.

In an attempt to limit coverage for non-functional damage, insurers have begun to include the “cosmetic damage” exclusion. Cosmetic damage is usually defined as marring, pitting or other superficial damage from hail that alters the appearance of the roof, but does not prohibit it from functioning as a moisture barrier.

What does your policy have?

Flood

If you have a single family home you more than likely have a HO3 policy. Condominium is an HO6. These policies do not cover rising waters. Rising waters from ocean, lakes, rivers, collection of rain in the road or land from excessive rain. Called “ground water”, simply put water from the sky that hits land and then enters your structure is Flood damage.

If you have a single family home you more than likely have a HO3 policy. Condominium is an HO6. These policies do not cover rising waters. Rising waters from ocean, lakes, rivers, collection of rain in the road or land from excessive rain. Called “ground water”, simply put water from the sky that hits land and then enters your structure is Flood damage.

You need to consider purchasing a separate policy to cover ground water; coverage for this would be to purchase a flood policy. Flood is an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties.

Screen Pool or Metal Structures

A tree falls and hits your pool screen enclosure or your attached metal car port.

A tree falls and hits your pool screen enclosure or your attached metal car port.

Depending on your policy language you might have limited coverages, or these structures might be excluded. If covered, you might have a limit on the dollar value. Is the dollar value enough to cover the replacement of the structure?

What does your policy have?

Leak in roof or window

I observed water damaged from a heavy rain storm around my windows. The water has damaged my wood floor system, drywall and baseboards. I’m covered, right? I notice water stains on my drywall ceilings in my home after a heavy rain storm. I’m covered, right?

Many policies exclude or limit coverage for interior water damage unless there is evidence of a wind-created opening in the roof, outside wall, door or window where rain entered the home or business. Often carriers deny coverage in a manner similar to the below scenario:

Many policies exclude or limit coverage for interior water damage unless there is evidence of a wind-created opening in the roof, outside wall, door or window where rain entered the home or business. Often carriers deny coverage in a manner similar to the below scenario:

On such and such a date, a loss was reported to Insurance Company for water damage from roof leak causing damage to your home. The insured property was inspected by Mr. Adjuster who documented the claimed loss and determined there was no damage to the roof (or window) due to a weather condition. Because there was no storm damage to the roof then there would be no coverage for the interior damage.

The carrier then cites to the applicable water damage or wind-driven rain exclusion amongst other common policy exclusions to deny coverage. Policyholders should be aware of the following or similar policy language:

‘We do not insure for loss caused by rain, snow, sleet, sand or dust to the interior of a building unless a covered peril first damages the building causing an opening in a roof or outside wall, door or window and the rain, snow, sleet, sand or dust enters through this opening.’

What does your policy have?

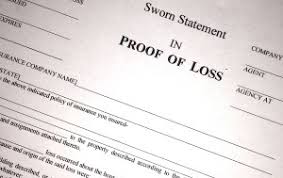

Proof of Loss / 60 day file

After you have a loss, you file an insurance claim, the insurance company will often mandate that the policyholder complete and sign a form called a Proof of Loss regarding the damages claimed by the policyholder. A Proof of Loss is generally one page form (possibly with attachments) that is usually provided to the policyholder by the insurance company.

After you have a loss, you file an insurance claim, the insurance company will often mandate that the policyholder complete and sign a form called a Proof of Loss regarding the damages claimed by the policyholder. A Proof of Loss is generally one page form (possibly with attachments) that is usually provided to the policyholder by the insurance company.

The Proof of Loss form requests specific information from the policyholder regarding the date and time the loss occurred, type of loss claimed, the available insurance policy limits, and the exact amount of damages sought by the policyholder. The Proof of Loss form may also mandate that the policyholder attach any damage estimates or other calculations that support the policyholder’s claims.

There are some insurance carriers that now have this or similar language: “Submit to us, within 60 days after the loss, your signed, sworn proof of loss which sets forth, to the best of your knowledge and belief.”

![]() First, many insureds will simply be unaware of this new requirement or will not understand if/how it applies to them. Instead of requesting a proof of loss (which would confirm that insureds are aware of the requirement), this insurance carrier has snuck in this requirement knowing that many insureds may overlook and/or be confused by this requirement.

First, many insureds will simply be unaware of this new requirement or will not understand if/how it applies to them. Instead of requesting a proof of loss (which would confirm that insureds are aware of the requirement), this insurance carrier has snuck in this requirement knowing that many insureds may overlook and/or be confused by this requirement.

Second, if an insured does not comply with this “hidden” requirement, the insurance carrier will likely use this “failure to comply” with the policy’s “Duties After Loss” as a basis for claim denial.

Third, the new language is also problematic because it requests a proof of loss within 60 days after the loss occurs. But what about instances where insureds do not immediately discover damages? For example, what happens when a July windstorm causes damage to the roof of an insured property but the insureds are unaware of the damage until leaking occurs months later? Will Olympus take the position that the claim is barred because a proof of loss was not provided within 60 days of the July windstorm?

What does your policy have?

Personal Property - RCV or ACV coverage?

1. Replacement Cost Value (RCV): This method is usually defined in the policy as the cost to replace the damaged property with materials of like kind and quality, without any deduction for depreciation. It pays an insured for the value of replacing the damaged property without deduction for deterioration, obsolescence, or similar depreciation of the property’s value. The carrier assumes the cost of paying the full cost of repairing or replacing the damaged property.

2. Actual Cash Value (ACV): This method pays an insured for a similar item less depreciation. ACV is ordinarily determined in one of three ways: (1) the cost to repair or replace the damaged property, minus depreciation; (2) the damaged property’s “fair market value” (“FMV”); or (3) using the “broad evidence rule,” which calls for considering all relevant evidence of the value of the damaged property. The insured bears the difference between the depreciated value of the damaged property prior to loss and the higher cost of repairing or replacing it.

What does your policy have?

14 day limit (discovered) / Hidden water leaks inside walls – Not covered

How many times do we open up our interior walls in our homes to check for leaky pipes?

How many times do we open up our interior walls in our homes to check for leaky pipes?

Many homeowner policies have an exclusion which generally states we do not insure for a loss caused by constant or repeated seepage or leakage of water over a period of 14 or more days. Other policies state that a loss won’t be covered if the seepage or leakage occurs over weeks, months or years.

Arbitration Language in Policy

Insurance Carriers could offer you a policy with ‘mandatory” arbitration language in exchange for a reduction in your annual premium cost. Be cautious as arbitration language is legal, binding and used to resolve the claim value. Arbitration removes your current ability to challenge claim values.

This is a tradeoff that you, as the policyholder, should understand and ask yourself if you are willing to accept the risk of having carrier written policy language reduce your options to secure the proper claim payment value.

Currently 11 states ban arbitration of property claim disputes. Florida’s Office of Insurance Regulation as of 2022 has allowed insurance carriers to include this method of resolving claim value disputes and can be included in your policy language.

The growing use of binding, pre-dispute arbitration clauses poses a huge threat to insurance consumers. It represents a major shift in the balance of power between insurers and consumers.

Check out Public Citizens, a non profit consumer advocate since 1971. Their article on arbitration clauses in insurance policy has good information.

Roof Deductibles

Insurance Carriers could offer you a policy with additional “roof” deductible language in exchange for a reduction in your annual premium cost. Be cautious as this could hinder you financially to conduct repairs.

The new law passed by the State of Florida in 2022 to provide relief to the insurance carriers has many twists to the language that could impact you, the property owner. Ask to read the proposed policy language prior to securing the coverage and be careful to understand the coverage being offered for the reduction in your premium. Keep yourself from the surprise if you have to use the insurance policy for an unscheduled event to your property.

SB 2-D creates Florida Statute § 627.701(2)(c), permitting a carrier, with the approval of the Florida Office of Insurance Regulation, to offer special deductibles applying only to roof losses. SB 2-D creates Florida Statute § 627.701(4)(e)1 and 2 requiring mandatory language and disclosures on the declarations page for policies that contain deductibles applying only to roof losses.

SB 2-D creates Florida Statute § 627.701(10) addressing the mechanics of a roof deductible applying to losses other than losses from a hurricane. A separate roof deductible is permitted if the insured is given a premium credit or discount for the policy. If the separate roof deductible is offered by the carrier at the time of the initial issuance or renewal of the policy, the insured must sign a form approved by the Florida Office of Insurance Regulation in order to opt-out of the separate roof deductible.

If the separate roof deductible applies, no other deductible can apply. The separate roof deductible may not exceed the lesser of 2% of Coverage A limit or 50% of the cost to replace the roof. The roof deductible can only apply to a Replacement Cost claim and it cannot not apply to

- A total loss by a covered peril;

- A hurricane loss;

- A loss from tree fall or other hazard that damages the roof and punctures the roof deck; or

- A roof loss requiring repair that is less than 50% of the roof.

SB 2-D amends Florida Statute § 627.7011(3)(a), providing that, if a separate roof deductible applies, the insurer may limit the claim payment to Actual Cash Value of the roof until the carrier receives reasonable proof of payment of the deductible. Reasonable proof of payment includes a cancelled check, money order receipt, credit card statement, or copy of an installment plan contract or other financing arrangement requiring full payment of the separate roof deductible.

Underwriting

SB 2-D creates Florida Statute § 627.7011(5) applying only to policies issued or renewed on or after July 1, 2022. Florida Statute § 627.7011(5) prohibits carriers from refusing to insure a home with a roof that is less than 15 years old solely because of the age of the roof. If the roof is at least 15 years old, and the carrier requires the replacement of the roof to issue or renew the policy, the homeowner can have a roof inspection paid for by the homeowner. The insurer is prohibited from refusing to issue a policy solely because of the age of the roof if the inspector determines that the roof has 5 or more years of useful life left.

25% Rule under Florida Building Code for Roof Repairs

SB 4-D creates Florida Statute § 553.844(5) to provide that, if the existing roofing system or roof section was built, repaired, or replaced in compliance with the 2007 Florida Building Code or any subsequent editions of the Florida Building Code, then only the repaired, replaced, or recovered portion is required to be constructed in compliance with the current Florida Building Code.

What does your policy have

Some policyholders buy insurance coverage on “price point” vs. the fine details of the policy language.

Thanks for doing a health check on your policy.

GET IN TOUCH

Tell Us About Your Claim:

Contact Info

Recovery Insurance Adjusters

East Coast Florida:

4365 SW Thicket Court

Palm City, FL 34990

772-237-0892

West Coast Florida:

868 Banyan Court

Marco Island, FL 34145

239-877-1305

Joseph P. Connelly, Lic. #E157037

Proudly serving as your:

Insurance Adjuster in Stuart, FL.

Insurance Adjuster in Hobe Sound, FL

Insurance Adjuster in Port St. Lucie FL.

Insurance Adjuster in Vero Beach FL.

Insurance Adjuster in Ft. Pierce FL.

Insurance Adjuster in Palm City, FL.

Insurance Adjuster in Palm Beach County, FL

Insurance Adjuster in Marco Island FL.

Insurance Adjuster in Naples, FL.

Insurance Adjuster in Bonita Springs, FL

Social